Is Financial Advice Worthless For Most People?

How to invest if you have less than $8 million.

What’s the point of writing about personal finance and investing? Is financial education and investing advice actually useful to most people, or only for people with higher incomes and lots of cash to invest? Is financial advice mostly just “classist,” designed for a system that’s rigged to make the rich get richer?

A few months ago I was listening to a podcast on YouTube from a financial advisor who said that they only work with clients who have a minimum of $8 million of investable assets. And that’s a common thing in the investment industry; many financial advisors have asset minimums, because it’s just not worth it to them to take on clients with less money. They’re busy and talented and successful and in-demand, they only have so many hours to work, and they (understandably) go where the money is.

But I thought, “Eight million dollars?? If you have that much money, you don’t need a financial advisor! Just put that cash in a few FDIC-insured cash sweep accounts and money market funds and some stock and bond ETFs. If you earn only 4% APY; that’s an income of $320,000 a year! You’re set for life! Count your blessings and pay your taxes!”

Yes, I know that High Net Worth people have complex financial planning needs and can benefit from elaborate tax efficiency strategies, and it’s worth hiring professional help. People at all stages of life and all levels of wealth and income have different financial problems. But if financial advisors don’t even want to talk to you unless you have $8 million, what hope does the rest of America have? It’s hard for a lot of middle-class people to get good, fair, unbiased financial advice. It’s no wonder that so many lower-income people look at the stock market and the daily investing news and think “that’s not for me.”

Here’s the thing: over the years, I’ve had friends and colleagues from all walks of financial life. I’ve been friends with wealthy CEOs and ex-Wall Street guys and tech startup executives, and I’ve been friends with people who had to declare bankruptcy because of medical bills. I’ve had friends who got in over their heads with predatory credit cards that they were too young and inexperienced to understand. I’ve had friends who lost everything because of bad luck and bad timing and their own catastrophic decisions.

I believe that everyone deserves good financial advice, not just people with $8 million. Learning about money, learning about investing, figuring out how to make the most of your money and feel better about your money choices is one of the most worthwhile things we can do. Getting smarter about money is valid and valuable for EVERYONE at all walks of life. Whether you’re on the verge of bankruptcy or are celebrating a massive career breakthrough, whether you’ve got subprime credit or just won the lottery, we all can benefit from financial advice. We all can gain from investing in the stock market. It’s not just for the rich and privileged. The stock market on the whole is a good thing that is worth knowing about and worth participating in.

I have seen firsthand that it is possible to make dramatic improvements in your career, to make more money, to change your whole life for the better. Investing in the stock market and learning more about how money works has been a big part of my journey. Back when I was in my 20s, I never dreamed that I would be entrepreneurial. I never imagined that I would make a living by writing about investing, that I would want to think about becoming a Certified Financial Planner. None of that was on my radar.

Me at age 20: “I don’t care about the stock market; I just want to do meaningful, idealistic work that I believe in!”

Me at age 40+: “The stock market is one of the few things that I still believe in!”

But I also don’t want to be a “rah rah” guy who’s a just a smiley happy cheerleader for entrepreneurship and capitalism and hustle culture, who tries to give a sense of false hope. Too many finance guys talk about investing like everything is fine and dandy, the economy is always getting better, and in the long run, all of us are gonna get rich.

But lots of people are left out of that happy story. Life is hard. Starting a business is hard. Finding an extra few hundred dollars a month in your budget is hard. Sticking with a disciplined plan of investing for the future instead of enjoying your money today is hard. Staying gainfully employed and financially solvent long enough to avoid raiding your retirement savings for emergency expenses is hard. Not everyone can do this.

And for a long time, earlier in my career, I didn’t entirely “believe” in capitalism. I just kept shoveling money into my retirement savings accounts each month, through one stock market downturn after another, just in case capitalism didn’t collapse. I’ve seen some things in my life: the dotcom bubble and bust, the Enron scandal, 9/11, the real estate bubble and bust, the Global Financial Crisis, the Great Recession, the pandemic, the high inflation that broke everyone’s brains. There have been so many moments throughout my working years where it seemed like the world was falling apart, like the system was rigged, like America’s most powerful institutions were run by the stupidest, most corrupt, most malevolent idiots on Earth.

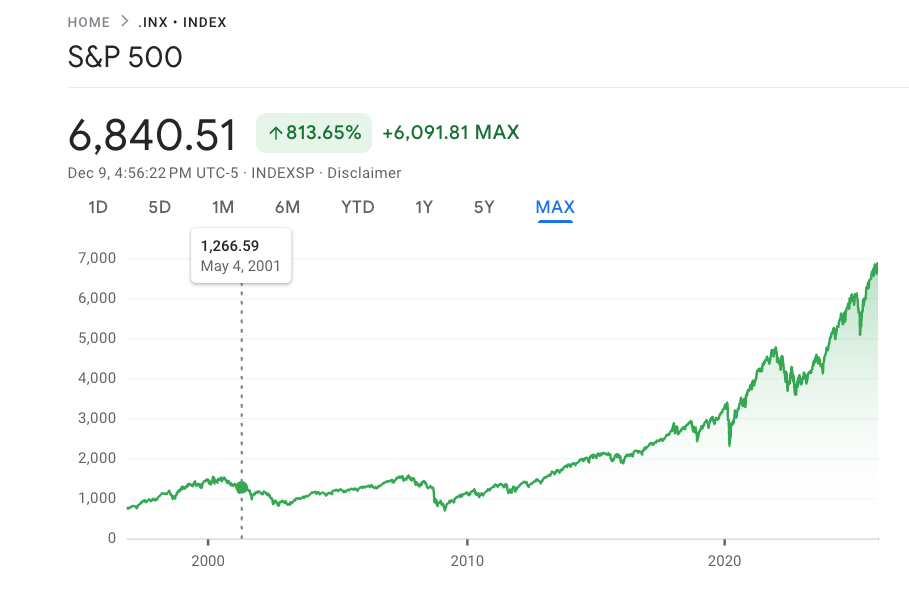

And yet…ever since I graduated college, my life, my career, my own cozy little part of the world, has mostly kept getting better. And the stock market has mostly kept going up! Look:

Stocks go up and stocks go down. Some stocks plummet and can even go to zero. But most of the time, in the long run, the stock market (as defined by the S&P 500 index, the 500 largest publicly-traded companies in America) goes up!

If you invested $1,000 in the S&P 500 on the day I graduated from college in May 2001, today that investment would be worth $8,301.

Here’s how much money you’d have today if you each of these amounts invested in the S&P 500 index in May 2001 -- without doing anything crazy, without picking stocks, without saving another dime:

$10,000 invested in May 2001 = $83,014 in Nov. 2025

$50,000 invested in May 2001 = $415,074 in Nov. 2025

$100,000 invested in May 2001 = $830,147 in Nov. 2025

That’s serious money. Those are numbers worth saving for, aiming for, striving to invest for. Those are numbers that can pay for college tuition and dream vacations, that can build a prosperous retirement, that can create generational wealth, that can take care of people you love for years to come. Those are numbers that are in reach for a lot of middle-class investors.

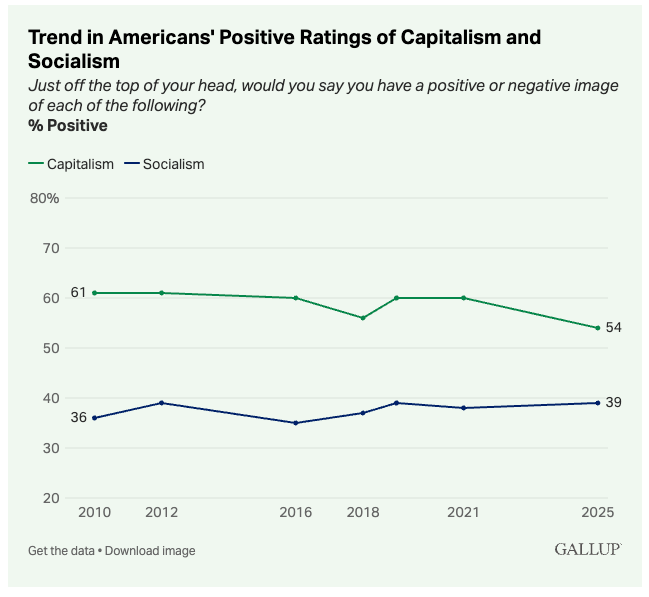

Capitalism isn’t very popular right now in America. A recent Gallup poll found that only 54% of Americans have a positive view of capitalism, down from 61% in 2010.

Lots of Americans feel left out and left behind by capitalism, like the cost of living just keeps getting more expensive, and they’re not seeing enough rewards for their hard work. I get it. I’ve been there. When I was a young working adult in the early-to-mid 2000s, the idea of “investing” felt totally abstract; the idea of retirement felt impossibly far away. Saving for retirement and investing in the stock market was just something that boring old guys in bad suits talked about on TV. “Well, okay fellas, whatever. I guess I’ll put my puny little savings into this thing called The Stock Market. Maybe it’s not all a scam like Enron or doomed like the dotcoms!”

But the years passed, and I kept working and trying, earning and learning, saving and investing. And today I’m grateful to have something to show for all years. That’s why we invest: to create a future, to create a place of safety. We send some money on a long journey to our future selves, in the hope that it will grow along the way, in the hope that one day it will sustain us. Saving money is saving yourself.

I haven’t always believed in capitalism, but I do believe in Math. The numbers don’t lie. The stock market isn’t just for rich people. 62% of Americans own stock. There’s a vast cohort of middle-class retirement investors who own stocks, who are seeing meaningful investment gains, who are (hopefully) going to stick with it for the long run and someday will be able to retire with a lot more money than they expected. If you’re able to set some cash aside each month, from every paycheck, and invest it in a broadly diversified, low-cost index fund that tracks the S&P 500 or the total U.S. stock market, in the long run, you’ll most likely make money. Let hundreds and thousands of America’s publicly traded companies go to work for you everyday, making you richer. I have. Even after all the disasters that happened throughout my working life, the numbers got a lot bigger. It worked! USA! USA! USA!

And I recognize that what worked for me might not work for everyone. I’m lucky. I’m privileged. We live in a viciously competitive, deeply unequal society. Lots of poor people and working class people and middle class people can’t reasonably afford to save and invest, and are just kinda “stuck” in America. It’s all too easy to fall into a trap where you’re barely making enough to pay the bills, where you’re buried in student loans and high-interest debt that you can never get out of. American consumer capitalism is built upon constantly tempting people with a slightly nicer lifestyle, some shiny new thing, some expensive new bauble that they can barely afford. Many Americans get stuck on the treadmill of “lifestyle creep,” where they just keep spending 98% of what they earn, where their house and cars and furniture and wardrobes keep getting more expensive while their investment accounts are underfunded.

And some Americans have bad luck that ruins their financial plans. American life is risky and expensive. Lots of people have to borrow a bunch of money to go to college. You typically have to borrow to buy a reliable (expensive) car to drive to work. You could get sick or injured and have to be hospitalized and owe thousands of dollars in medical bills (even with expensive health insurance). You could lose your job and not find another good one anytime soon. You could become disabled due to a car accident or health crisis. You could get laid off from the best job (and best health insurance) of your entire career at age 50+ and spend the rest of your life being age-discriminated against, never getting back on track, never regaining your peak earning power. All of this is true. Canceling a few unused TV subscriptions isn’t going to make a difference.

But I also believe that almost everyone can do something, can take some meaningful steps forward, to improve their financial situation. This might include:

Fixing your credit

If you’re in the subprime credit score range (with a FICO score of less than 670), you need to do whatever it takes to rebuild your credit. Make it your #1 priority, maybe even before saving up cash to build an emergency fund.

People with subprime credit are at a massive disadvantage in life. If you have less than fair credit, you’re in America’s financial underclass; the worst companies in the financial industry are basically legally allowed to prey upon you and cheat you and harvest your organs. Having a low credit score makes you a target for discrimination; you can get denied jobs and rental housing because of it. It’s a nightmare.

But there is hope! Figure out how to get better organized at paying bills on time and rebuilding positive credit history. Credit Sesame is a credit score education app that I’ve researched before; it has free tools to help you understand your credit score and see how taking specific actions could improve your score. You also might want to think about using a secured credit card to get back in the good graces of the credit bureaus. But don’t use “credit repair” companies; they are usually scams.

Saving $1,000 of emergency cash

According to the Empower 2025 “Safety Net” study, 32% of Americans have no emergency savings, and 29% said they wouldn’t be able to afford an emergency expense over $400. What if you could save $1,000 of cash? That’s only $83.33 per month for one year. Cancel your TV subscriptions for one year. Put that money in a high-yield savings account. Watch your safety net grow.

You don’t need three to six months of emergency expenses; that’s not realistic for a lot of people who are barely keeping their heads above water. Instead, try to save up a smaller cash cushion that can bail you out in case of a car repair, a medical bill, or some other short-term needs.

Investing just a little bit each month

Do you have a job with a 401(k) plan or other qualified retirement plan? Do you get 401(k) matching money from your employer? If so, use it. Don’t leave money on the table. Even if you can only afford $50 or $100 per month, it can make a difference over time. Or if you don’t have a 401(k) at work, use a traditional or Roth IRA account; if you qualify based on income, you can invest up to $7,500 for 2026.

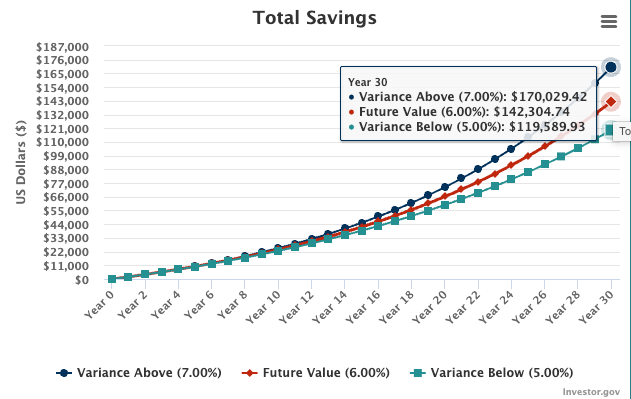

Let’s say you invest $100 per month in your 401(k) and your employer matches 50% of that, for a total of $150 per month. After 30 years, you could have $170,000 (assuming 7% average annual returns). That’s not enough to retire on, but it’s a good start, and it’s worth doing.

Look!

Giving your investments a tune-up

If you are part of the 62% of Americans who own stocks and are saving for retirement, what next? Many Americans might have some money saved up in their 401(k), but aren’t sure how to maintain the momentum and stay on track.

Ask yourself these questions:

Do you have a retirement savings goal?

If you can save $1 million by retirement, that would generate $40,000 per year of income. $1 million sounds like a huge number, but you don’t have to save it all at once; most of your retirement nest egg will come from long-term compounding, not just the money you put in from your paychecks. Take a look at how much you’ve saved so far. Use the free compound interest calculator at Investor.gov to see how your savings could grow.

Do you understand what stocks, bonds, or other investment funds you own?

Investing in 401(k) plans can be complex, because the exact funds that you can choose from depend a lot on your employer. Different companies hire different 401(k) fund managers and HR platforms to provide their employees with investment options.

In general: you should try to own a diversified portfolio with lots of different stocks and some bonds. The best 401(k) plans might also offer you a target date retirement fund, where you can choose a target year based on when you’re going to reach retirement age. This can help you automatically get set up with an appropriate mix of stocks and bonds for your age and long-term goals.

Do you know how much you’re paying in investment fees?

Read the fine print on your 401(k) or any other investment account to see how much the investment funds cost. The best low-cost index funds are often available through companies like Vanguard and Fidelity, with low fees. For example, the Vanguard Total Stock Market Exchange Traded Fund (VTI) has an expense ratio of only 0.03%.

Index funds like the VTI tend to be cheaper, because they are “passively managed” funds; they just go out and buy an entire market index, like the S&P 500, with lots of small amounts of shares of thousands of companies at once, without trying to pick stocks or beat the market. But some higher-cost funds, such as actively managed funds that try to pick the right stocks for you, might charge fund fees of 0.60%-1.0% or more.

Fund fees have come down in recent years, but it’s still worth reading the finExpenses matter, because the more you pay for fund fees, the less money you get keep. And higher-cost actively managed funds don’t always deliver bigger ROI than low-cost passive index funds -- you might be paying for performance that you’re not actually getting.

Are you investing in a way that’s appropriate for your age, income, time horizon, retirement goals and risk tolerance?

“Risk tolerance” is a tough thing to measure. The idea is, you should invest in a way that lets you sleep at night. You shouldn’t take on too much risk by investing 100% of your money in stocks unless you’re confident that you can handle the short-term emotional roller coaster. But not everyone knows how they’re really going to feel about risk until the stock market crashes and they see their retirement savings go down by 20% or more.

Another risk factor is diversification: are you putting too many eggs in one basket by investing too much money in just a few stocks, or in one type of stock (like tech or AI or financials)? Some people have the opposite problem, and are too risk-averse: they might have too much money in cash or bonds. They might need to put a larger percentage of their retirement money into stocks, in hope of gaining bigger long-term growth.

In general: younger people can afford to take more investment risk by putting a higher percentage of their retirement savings into stocks. And most people who are close to retirement (or already retired) shouldn’t retire from the stock market. The Vanguard Target Retirement 2025 Fund -- an investment portfolio that Vanguard recommends for people who are retired right now -- includes a mix of about 50% stocks and 50% bonds.

It’s understandable that many Americans are gloomy about their personal finances. Saving for retirement 30+ years into some unimaginable future might feel daunting and pointless when you’re struggling to afford life today. But we’re not all completely trapped and helpless and incapable of having agency to make meaningful choices about our money. Maybe some people are trapped; I feel for them. If your life is a nonstop emergency, it’s hard to plan for the future or get motivated to make clever strategic money moves. People get worn down by the everyday grind of paying bills.

I wish America had a stronger social safety net. I wish we had universal health insurance and better-funded public pensions through Social Security. I wish no one had to worry about paying medical bills or affording their chemotherapy or fending off calls from debt collectors after losing a job. I wish so many Americans didn’t have to live a life of constant stress and peril and dread. I wish we didn’t have to work so hard, and more Americans could take a long vacation every year, and young parents could spend more time at home with their children. I wish everyone could be taken care of, and prosperous Business Dads like me could help pick up the tab by being a little more generous, by paying a little more taxes.

But you see: those things are not very popular with American voters. “Taking care of people” and “having affordable healthcare and well-funded public schools” and “creating a beloved community of widely shared prosperity with a spirit of solidarity” and “having well-maintained parks and public transit and public spaces where Americans can co-exist in harmony as relative equals” is just not a winning strategy in American politics. We can’t wait around for politics to save us.

So in the meantime: let’s get smarter at investing!

Here’s one of my favorite articles I wrote about retirement planning: You Don’t Have to Be a Millionaire to Retire. Here’s Why.

FunMoneyDad.com content is for informational and educational purposes only and should not be considered to be financial advice or investment advice. Consult with your own professional advisors before making any investment decisions.