Top 11 Provocative Hot Takes On How To Manage Your Money

Financial literacy doesn't have to be boring.

The Internet is jam-packed with boring financial advice:

“Pay off credit card debt! Stop going out to lunch everyday and cook meals at home! Give up that $5 coffee! Set a budget! Cancel your TV streaming subscriptions! Deprive yourself of all joy and spontaneity! Save 3-6 months’ worth of expenses in a high-yield savings account! Invest 10-15% of your salary in a diversified portfolio of mostly stocks!”

All of this advice is well-intentioned and might even be helpful, but it tends to run together into a milquetoasty, uninspiring fog of blah. No wonder people struggle with financial literacy!

Instead, I want to offer a few money “hot takes” that I’ve learned and developed over the years from my work as a freelance finance writer.

1. Most financial advice is unrealistic.

Here’s the biggest problem with most financial advice: it doesn’t fit the reality of how most people live, earn, spend, and save. Different people have different problems. People with more money are able to benefit more from saving and investing.

If you make $300,000 per year, it’s easier to benefit from clever strategic year-end tax moves, and saving 10% of your income will put $30,000 per year into your retirement nest egg. Investing $30,000 per year and earning 7% average annual returns for 20 years will give you $1.23 million. That’s serious money!

But most people can’t comfortably afford to save $30,000. If you only make $30,000 per year and are barely able to afford the comforts of a “middle class” lifestyle, saving 10% of your income (while possible!) might feel too painful to contemplate.

And yes, giving up that $5 daily Starbucks run might help you save $1,825 per year -- but most people don’t live that way and aren’t going to live that way. Even if you stopped spending $5 per day on coffee, most people aren’t going to put that $5 into the bank or into their brokerage account. People need to have a little fun along the way. People need their little $5 treats. Is that so wrong?

2. Credit card debt isn’t always bad.

Yes, if you have credit card debt, you should make it a priority to pay it off as soon as possible. Credit card is terrible for your finances because it costs you higher interest than any investment is likely to pay. There’s usually nothing better to do with your extra cash than to pay off your credit card debt.

But that doesn’t mean credit card debt is always bad. Sometimes it’s a lifeline. Sometimes you need to rack up some credit card debt to repair your car, pay a bill, deal with a short-term lack of income, or just get through the ups and downs of life. Credit card debt doesn’t always have to last forever. Not everyone is flush with cash and has a six-month emergency fund. Sometimes people have to use their credit cards as an emergency fund, and that’s OK.

3. You don’t (always) need a budget.

Confession: I don’t have a budget. I have a spreadsheet that keeps track of my family’s typical monthly expenses, and then I try to earn at least that much every month. I also save money separately from this spreadsheet. I also put money into retirement savings. Am I “doing it wrong?” Possibly! But this works for me!

People are often resistant to starting a budget because it feels stressful and boring and self-depriving. “Budgets” sound like bureaucracy and deprivation. “Budgets” are something that boring guys in bad suits talk about on C-SPAN. “Budgets” are something that people in powerful positions are always cutting to deprive you and your loved ones of something good that you wanted and were counting on. (“Sorry, you don’t get a pay raise this year because there just isn’t room in the budget.”)

Yes, if you’re struggling with your money and are racking up credit card debt and don’t understand where your money is going, it can help to set a budget. There are great tools online now to help track your money automatically by syncing with your bank accounts. Years ago, I used the beloved free online spending tracker tool Mint (R.I.P.) before it got acquired and ruined by Intuit; now I use Quicken Simplifi.

But I don’t use a budget to “deprive” myself or my family of what we need; I just want to know where our money is going, what income numbers I need to hit, and how much flexibility we have from month to month.

(Huh, maybe I do have a budget after all? Maybe I’m not actually such a Budget Maverick?)

4. Earning beats saving.

Yes, it’s good to build up healthy saving habits. Figure out how to save 10% (or more) of your income. Make a habit of putting money into your retirement accounts every month, every payday.

But if you’re struggling to save money each month, if you’re living paycheck to paycheck, if you don’t love being frugal…it’s time to boost your earning power.

Ask for a pay raise. Look for ways to add more value at your job (or start looking for a new, better job.) Can’t switch jobs right now? Work overtime.

Don’t want a new full-time job? Get a side hustle. Start a business on your nights and weekends.

Want a longer-term career change? Learn new skills. Go back to school for another certificate or degree or license.

I don’t love being frugal. I’m not great at it. My family’s life is very expensive; we spend a lot on healthcare and food and insurance. My money spends itself, whether I like it or not! Thousands of dollars just go flying out of my bank account every month! And that’s OK. I love our expensive life and I’m willing to pay a lot for convenience, so I can save time, so I can spend my limited free time doing more of what I do best. I’d rather just go make an extra $100 than save $100 by canceling our Hulu TV subscription.

And I’m lucky, because: as a freelance writer, my income can actually go up every month! If I’m in-demand, if I have plenty of projects lined up, the harder I work, the more money I make. Sometimes business is slow and I’m not busy enough and I don’t make as much as I want to make for reasons beyond my control. But as a self-employed person, I constantly have the freedom to keep pushing myself in the direction of greater growth and opportunity. The more I work, the more I make.

“Making more money for doing more work” doesn’t always happen at most full-time jobs. Too many jobs expect people to work extra hours and make big sacrifices for no additional pay. Remember the “quiet quitting” fake media trend a few years ago, where employees were being criticized for being lazy slackers (a.k.a. “doing their jobs”? Fun times!

5. Only talk to fiduciary advisors, not salesmen.

There are a lot of people in this world who call themselves “financial advisors,” but not all of them have your best interests at heart. Some of them are just financial salesmen who want to sell you the product that pays them the highest commission. Before you act on any investment advice or buy any financial product or sign up for any financial service, make sure you’re talking to a fiduciary -- someone who is professionally and ethically obligated to put your financial interests first.

Too many people have ended up getting sold expensive, confusing financial products that aren’t the right fit for their goals -- or worse, scammed out of their money altogether -- by disreputable financial “advisors” who are actually just salesmen. And not all financial salesmen are “bad.” There are plenty of good people who get paid on commission; your insurance broker might also be able to answer other questions about your money and point you in the right direction for what to do.

But buyer beware. Too many so-called “financial advisors” have overcharged their customers and put people into the wrong investments with high fees and low returns that underperform the S&P 500. Fiduciary advice is worth paying for. Everyone else might just be reaching into your pocket.

6. CDs are the wrong choice for almost everyone.

I don’t understand why anyone buys certificates of deposit (CDs) anymore. There are better things to do with your cash. The best high-yield savings accounts, money market funds and cash sweep accounts will give you FDIC insurance (like a CD) and an APY on your savings that is almost as high as a CD.

CDs make you lock up your money and charge you penalties to get it out early. I don’t like that deal. Unless you have millions of dollars in cash and it’s worth earning an extra 0.25%-0.50% per year, steer clear of CDs.

7. Just a few hundred dollars a month can make you rich (enough) in retirement.

How much money is “enough” to save for retirement? What’s the smallest amount you can save that for retirement that’s worth bothering with, that really moves the needle and makes a difference?

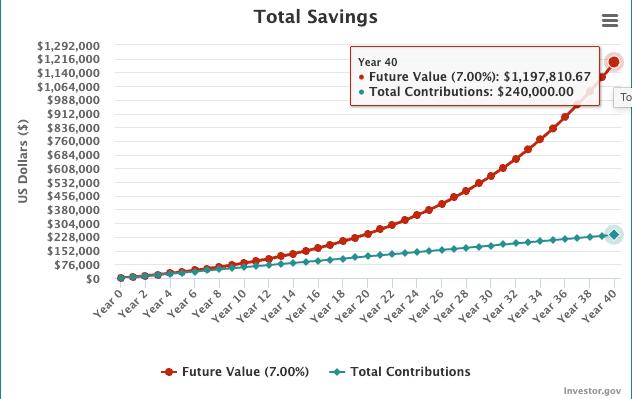

Let’s say you’re 27 years old and you want to save for retirement for the first time. Can you afford to save $300 per month?

If you can save $300 per month for 40 years (until this hypothetical 27-year-old’s 67th birthday, when they reach Social Security eligibility), and you earn 7% average annual returns on those investments, you’ll have $718,686. If you withdraw 4% per year for retirement income, that will give you $28,747 per year (before taxes). And that’s on top of whatever income you get from Social Security.

What if you bump it up to $500 per month, starting at age 27? Assuming 7% average annual returns, you’d have $1.19 million to retire with at age 67. That nest egg would generate $47,600 in annual retirement income (assuming 4% withdrawals per year).

And it’s (almost) never too late to start. But the earlier you start saving for retirement, the more time you have for that money to grow with the magic of compounding.

8. Almost everyone can do something -- right now -- to improve your financial life.

I feel like a lot of Americans are despondent and living in learned helplessness about money. People are stressed out. Life is expensive. Paychecks don’t stretch as far as they used to. We are surrounded by modern marvels like pocket-sized supercomputers and the hype around AI, while also feeling distracted and pestered by digital noise and clutter, overworked and overextended and isolated.

Life in the 21st century feels nerve-wracking and vaguely disappointing most of the time. We were promised flying cars, but instead we got stupid political unrest and social media doomscrolling. The idea of dutifully investing 10% of our income each month feels daunting and maybe even pointless. Why deprive ourselves of a sunny vacation and happy memories while we’re young and vital, just so someday in the far-off and unimaginable future when we’re old, we can maybe afford a nicer room at the nursing home?

I believe that we have a moral obligation not to surrender to despair and financial nihilism. Everyone has choices. Everyone has power. You don’t have to cut yourself off from every weekend trip with friends or every happy little $5 coffee purchase. But I believe that (almost) everyone can make smart money moves to improve their finances.

It doesn’t have to be huge and dramatic. Start small. Save $50 this month. Set up autopay for your credit cards and other bills. Choose one subscription to cancel and save $18-$20 per month. If you’re feeling underpaid and unappreciated at work, take one step to update your resume and start looking for a new job. Put 1% of your salary into your retirement savings.

Or even if you’re not ready to move money or invest, start researching your options and making a plan. Look at the best debt payoff apps for getting out of credit card debt. Read about how to open a Roth IRA. Make a list of people you know who you’d like to have coffee with to talk about networking for a new job, or learning a new skill, or getting advice on how to make a career change.

9. Warren Buffett is the only billionaire whose advice you should listen to.

Warren Buffett recently retired as CEO of Berkshire Hathaway. During his long career as a legendary investor, he amassed a net worth of about $148 billion. But despite his vast riches, Buffett maintained a well-deserved reputation for being relatively down to Earth and humble in his outlook. He kept eating at Dairy Queen and drinking Coca-Cola and living in Omaha, Nebraska in the same house he bought when he was a much less-wealthy younger man.

Not every billionaire is worth listening to. Some of them become cranky and weird and out of touch with humanity; they start selling crappy altcoins and SPACs and dubious longevity hacks. Most billionaires’ advice isn’t relevant to most people, and what worked for them might not work for you. But Warren Buffett offered some good financial advice that lots of everyday people might benefit from.

Here are a few of my favorite Warren Buffett financial advice quotes:

“In my view, for most people, the best thing to do is own the S&P 500 index fund.”

Diversify. Warren Buffett was one of the best in the world at picking stocks. But most people aren’t that good, or that lucky. If you just buy and hold the entire S&P 500 -- the top 500 biggest publicly traded companies in America -- or another broad, diversified index fund, you can own the future profits of corporate America. You don’t have to pick stocks. Most people shouldn’t try.

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

Invest for the long term. Warren Buffett was investing for more than 60 years. That’s a lot of time for investment returns to compound. He started with relatively small amounts of money and bought shares of stock in companies that he believed in, and (most of the time) he held onto the shares of companies for the long run. Warren Buffett was a long-term investor, not a day trader.

“The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.”

The stock market is powered by greed and fear, hype and FOMO (“fear of missing out”). But fear of missing out on getting rich, or jealousy or other people getting rich, or getting greedy and taking big risks because you’re chasing the big gains that other people are seeing, are all terrible reasons to invest.

I don’t really participate in any “communities” about investing. I don’t talk much about my investments with many other people. I don’t want groupthink and peer pressure. There are too many (mostly) young dudes on the Internet that are egging each other on to take big risks and make bad decisions. I like to follow the markets and I read lots of financial news, but I’m cautious about whose opinions I actually listen to and which commentators I follow.

When saving and investing, unless you’re a Wall Street hedge fund manager who’s under pressure to beat the market and keep your wealthy clients happy, you’re not actually in “competition” with anyone else. You have to run your own race.

10. Do what helps you sleep at night.

Should you pay off your car loan early or put that extra $400 per month into savings? Should you invest in 90% stocks and 10% bonds, or 80% stocks and 20% bonds? Should you change your investment asset allocation because the stock market is at an all-time high and you feel nervous that the market could crash?

There’s usually not one “right” answer to any financial question, but often the best answer is: whatever can help you sleep better at night. If you’re up late worrying about your budget, your savings account balance, or which debt to pay off first, just try to do whatever will give you the greatest sense of peace and the ability to rest. Go with your gut. Go in the direction of calm.

11. It’s better to be a spendthrift than a miser.

Back in the early 2000s when I was just recently out of college and earning “real job” money for the first time, I decided to get smarter about personal finances and investing. One of the first books I read about money was literally called The Complete Idiot’s Guide to Personal Finance. (Apparently I had some self-doubt and imposter syndrome about money in those days; otherwise I wouldn’t have chosen such an insultingly-titled book.)

But this book was actually a good start for learning about money! And I still remember the first bit of advice that I learned from that book whose author thought I was a Complete Idiot: “It’s better to be a spendthrift than a miser.”

If there are two extremes for how your financial life can turn out -- with one end of the spectrum being “you spend every dollar you ever make, and you die broke” and the other end being “you grasp tight to every dollar you ever make, and you never spend or splurge or enjoy money along the way, and you die with millions of dollars…” you should choose the first one.

It doesn’t happen often in America, but it is possible for people to go through life without spending much money. A few years ago, there was an old man named Dale Schroeder who died in Iowa who had worked his whole life as a carpenter. He never married, never had a family, and he lived a humble low-cost life, driving an old, used pickup truck. And over the years, even on a modest income, he was able to save and invest and build up a nest egg of $3 million.

Dale had no living relatives. So before he died, Dale went to a lawyer and wrote a will saying that after he died, he wanted his money to be used to help kids from small-town Iowa go to college. And the money in Dale’s estate helped 33 kids go to college! That’s a wonderful example of generosity. And also a great example of how a lot of Midwesterners (like Warren Buffett) aren’t very flashy with their wealth; I actually love that about the Midwest. People here aren’t trying to impress everyone all the time.

Dale Schroeder did a wonderful thing with his life savings. His money lived on as a beautiful legacy of helping 33 total strangers go to college and get launched in careers. Dale was not a “miser;” he wasn’t motivated by greed, he was just frugal and responsible, and generous. He used money as a means to an end, to help the next generation thrive.

But sometimes people who become misers end up fixating on money as an end in itself. They obsess about numbers in the bank, balances on spreadsheets, and miss the everyday beauty of life around them. Some people are so frightened of running out of money that it holds them back from enjoying money while they’re alive, from having the experiences and relationships and memories that money can help provide.

At its best, money is a tool to help us live a life of greater abundance, joy, love and generosity. That’s why it’s better to be more of a spendthrift instead of a miser. Go out to lunch on a sunny day. Sit by the windows of your favorite restaurant. Take your friends out for drinks. Pick up the tab. Go on vacation, go to the beach, see the world. Buy the plane ticket. Buy a better, safer, reliable car to drive your family around. Give generously to good causes that you care about. Try not to spend your one and only precious life pinching pennies and clipping coupons. Instead, let money be a source of joyful energy in your life. Let the money flow through you, let it elevate you, let it help you thrum with purpose.

FunMoneyDad.com content is for informational and educational purposes only and does not constitute financial advice or investment advice. Consider consulting with a professional advisor before making any investment decision.